Each year Council collects rates to fund the community infrastructure and services that make the Northern Beaches such a special place to live.

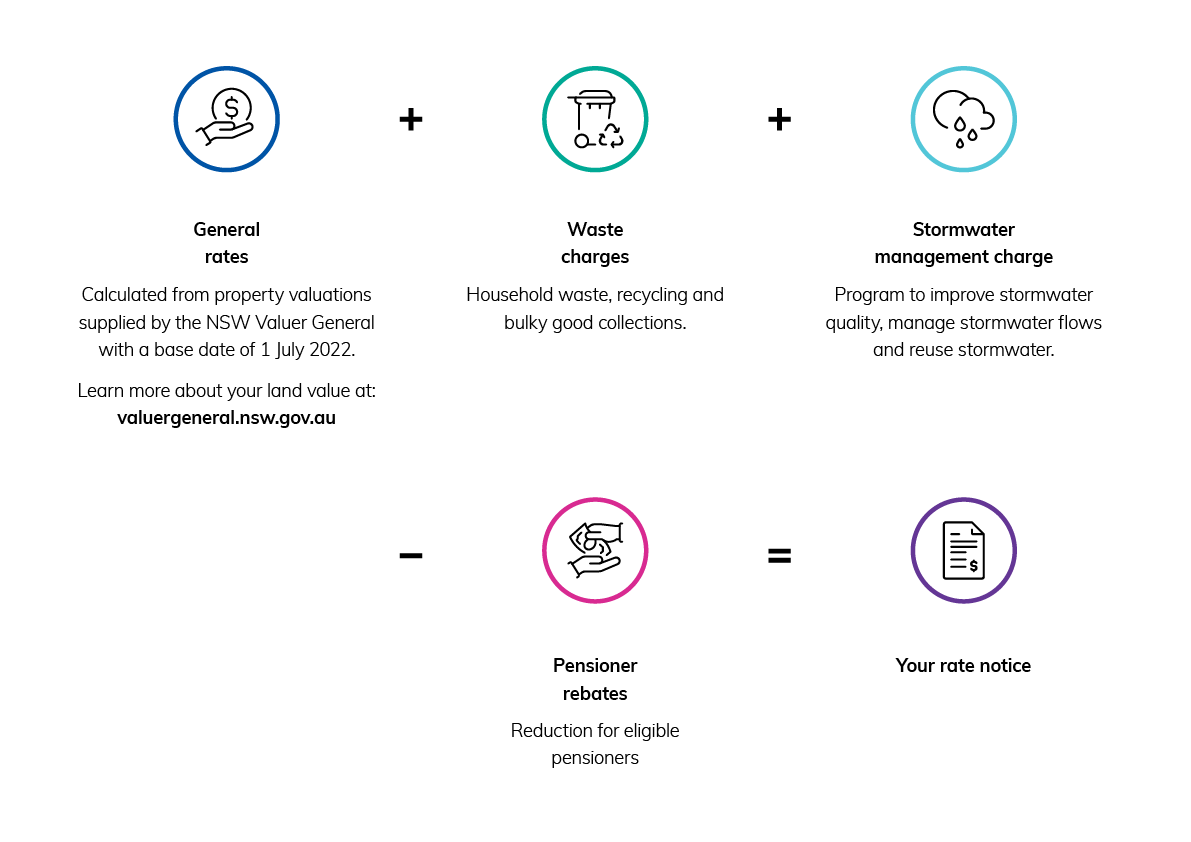

Your rates notice may also include charges for Domestic Waste and Stormwater Management Services.

See our budget highlights and summary of spending areas and view our interactive map to see what is planned for your area.

Read more about Council's activities and projects in our annual Delivery and Operational Plan.

Factors involved in the calculation of your rates

Rates may vary from year to year based on a combination of annual maximum increases approved by the Independent Pricing and Regulatory Tribunal (IPART) rate pegging and special rate variations (SRV) and/or changes to land values as supplied to Council by the NSW Valuer General.

The rate peg increase allowed by IPART relates to general income in total and not to an individual ratepayers’ rates. Individual rates are also affected by other factors such as land valuations by the NSW Valuer General. As such, rates for individual ratepayers may vary by more or less than the percentage allowable, depending on how an individual ratepayers’ land valuation has changed in a particular year compared to the land values of other ratepayers.

Land valuation

Rates for Northern Beaches Council properties for 2025/26 have been assessed using land values issued by the NSW Valuer General having a date of 1 July 2022.

For rates purposes, land valuations are calculated every 3 years by the NSW Valuer General. The total rates pool isn’t affected by the revaluation, but individual property rates can be affected to a small or large extent because of disproportionate value changed across large and disparate areas. The next land revaluation is due to take effect on Council’s rating structure on 1 July 2026.

Rates due date

Rates are levied each year for the period of 1 July to 30 June. You will receive an annual rates notice and then instalment notices four times a year, unless you pay for the year by the first due date – 31 August.

Rates payments are due by 31 August, 30 November, 28 February and 31 May.

Financial hardship

Council has a policy to provide assistance for ratepayers experiencing genuine financial hardship.

You may be eligible for a concession on the grounds of hardship. Council may also be able to assist by agreeing to alternative payment plans.

If you are having difficulty in paying your rates, you should contact Council as soon as possible to discuss the options available under Councils Rates and Annual Charges Hardship Policy.

Download the Hardship Rate Relief Form

Property owners with tenants

Council encourages property owners to pass on the Beach Parking Permits they receive with their rates notice to tenants.

Your rates & charges notice at glance